7/24 Will the Fed Cut?

Odds of when the fed will cut exactly, is the drawdown almost over?

I guess wow, finally enough data to make a comment on macroeconomic data again, it must be the week leading up to FOMC.

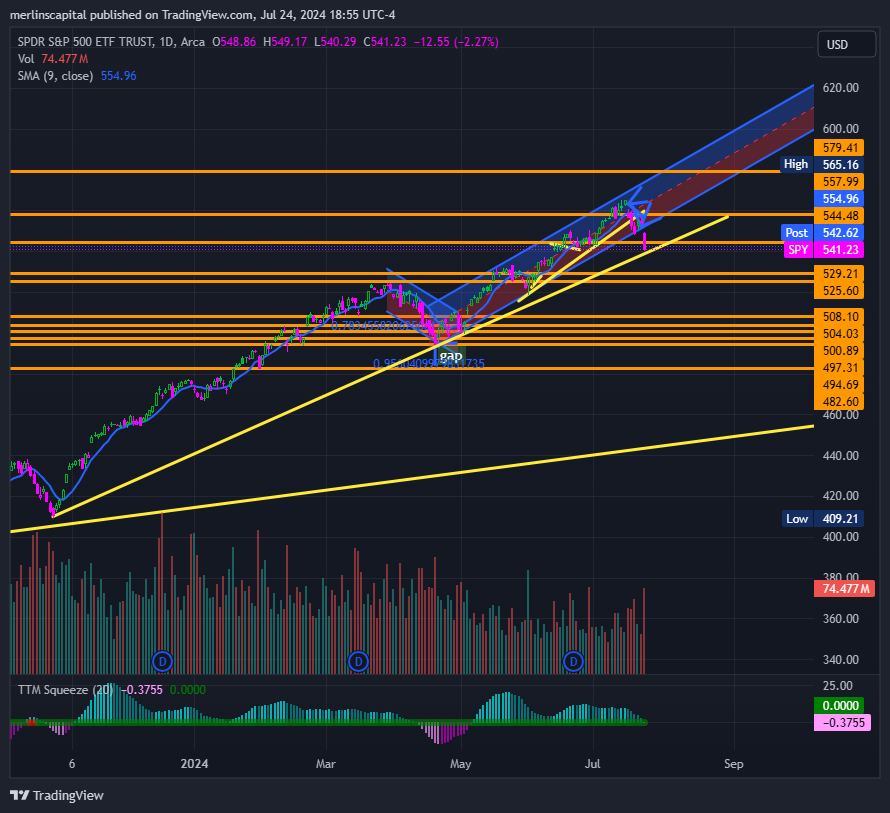

A lot of titles of what could be today’s paper. As I wrote in wiz chat today in pre-market expect a drawdown to 544 on SPY and then some collection to start. We ended up drawing down past 544, almost closing the gap at 537.

Conveniently though, SPY stopped right at its longstanding trendline, leaving large gaps above it.

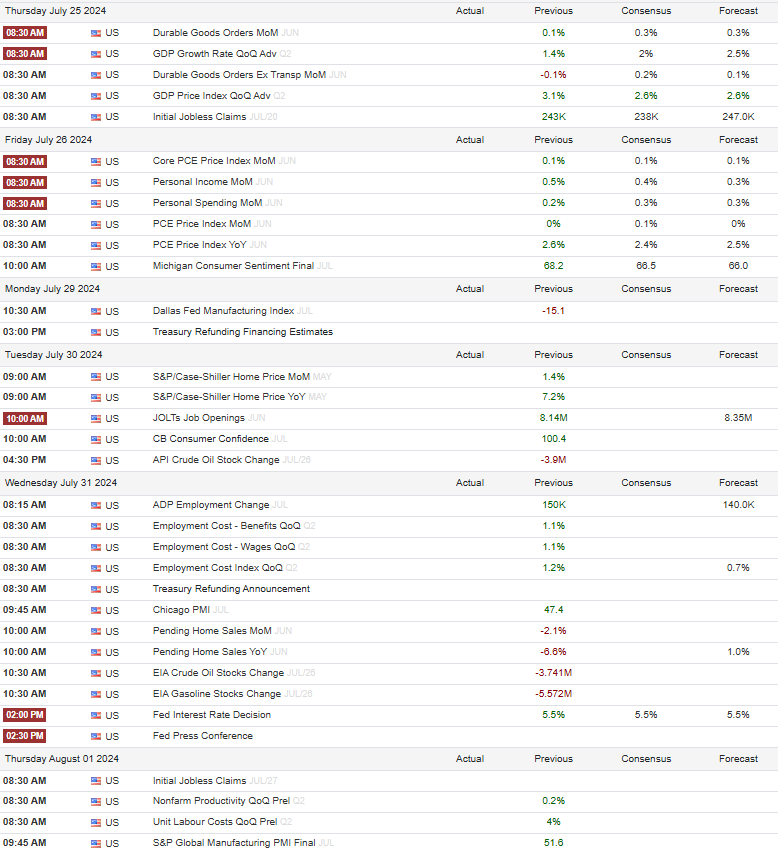

With GDP reporting tomorrow to kick off our data lead into FOMC, I can see markets finishing their drawdown and holding sideways until the actual FOMC meeting. PCE is already known from taking CPI and PPI together. What isn’t priced in right now and markets are unsure where to price is this FOMC.

First off, let’s look at the suspected chances for a rate increase in September that is what the fed is supposedly setting us up for -