4/25 SPECIAL EARNINGS REPORT

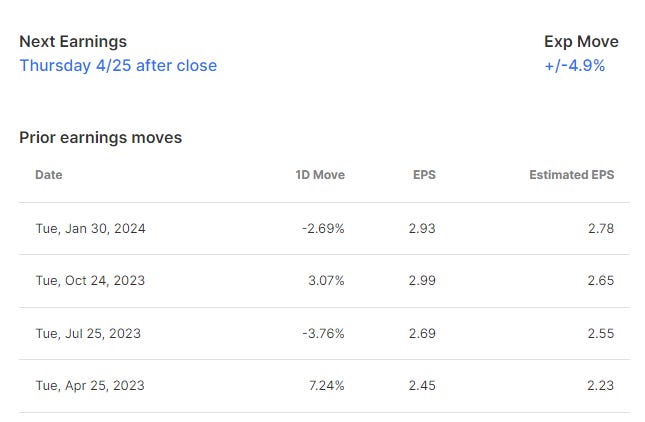

MSFT, GOOGL, GOOG, SNAP, INTC, DXCM, ROKU, XOM

Prelude - I think yesterday’s earnings were pretty meh especially since they led into GDP, after writing this today, I think there’s actually some pretty nice potential plays on the board.

Subscription Discounts

If you aren’t already taking advantage of the student discount I really encourage students to do it. I want education to be accessible and for my stack to be less than your Netflix Subscription.

Student Special:

I also take serious pride in this being an affordable educational site. I am adding a veteran discount on top of adding student discounts to subscriptions.

Refer a Friend and Receive Discounts off your subscription

VETERAN DISCOUNTS FOR WIZ SUBSTACK (need a vmail.vet address)

If you enjoy the stack, make sure to like this post, restack, retweet, subscribe to the tribe. It goes a long way and I think 95% of those that upgrade will say they’ve seen their trading improve incredibly. But enough of the biz, let’s get down to wiz.

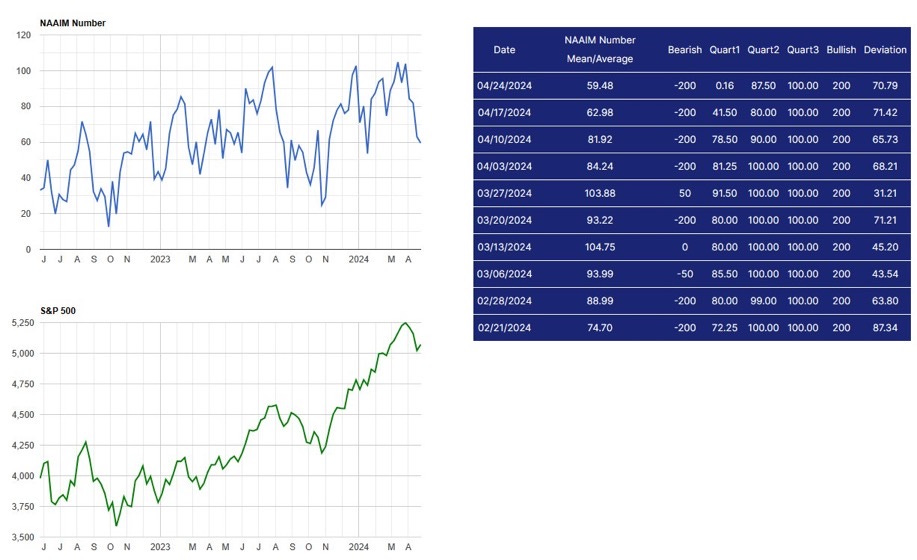

A really interesting week in ER’s so far, and as I posted in the wiz charts chat, vix suppression funds went active today for the first time in over 2 weeks. I think as I wrote in there it is directly related to NAAIM, and the market is set up for a large off balance move here. I also think today’s GDP number’s are going to prompt the fed to again a much more dovish state whether they want to or not, but still be forced to keep rates high. Similar to what they’ve done since November, but at this point, they really have no other choice but to do this. Because as I’ve written, the fed risks too much by moving in either direction right now in terms of rates. It is best for them to continue to sit w/ rates high and keep the environment disinflationary, hopefully enough so that stocks still swim higher and beat the large slowdown in GDP growth.

GDP growth drop as was one of my major concerns was driven by a drop in government spending. Almost causing it to halve. For now, it is best to look long as that is what VIX and HYG are signaling, but the dance might be up towards the back end of the year in a bad way for both markets and the economy, post election.

so this is my theory, VIX suppression funds magically go back online today after GDP, GDP was bad meaning the fed will likely want to loosen financial conditions from here. a great way to further juice the markets is to catch these behemoths of NAAIM offsides is to turn the vix suppression back on and squeeze them like they did back in november, so im leaning towards its a trap, we go higher on a squeeze